SUMMARY

Companies are like living organisms. They can grow, mature, change, or die. Mitcham Industries, whose name will soon be MIND Technology, was thought by investors as a dead made a complete transformation of its business model. For years, it operated one business segment. Then, it planted seeds for another business segment. The old business segment was slowly being wound down while the new business segment was growing and it is about to grow on steroids.

Some are paying attention because the stock price is up 2.5 x from during the last couple of weeks. No I did not buy it at the lows. I just bought my positions last week. It is ok because there is another 10x left. And if the stock pulls back, which I hope it will, I will be buying more. The new business segment is about to explode and US Navy is lighting that fire.

ARE YOU CRAZY?

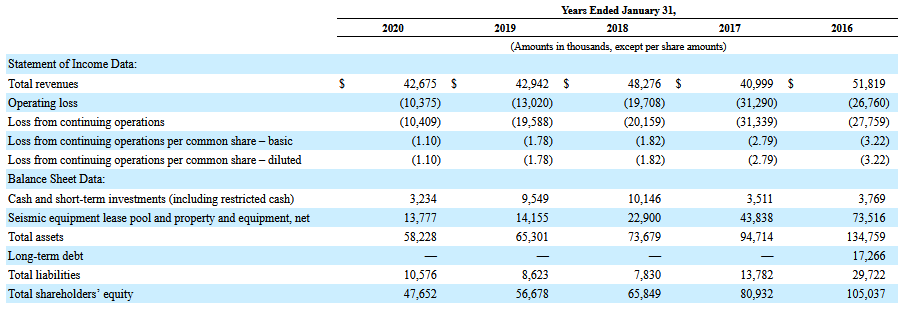

When you look the financials from the last five years, you might think that I am crazy. Revenues are trending down and operating losses are huge. The operating losses over these years amount to $110 million which is 5 times the current market cap of $23 million.

In order to see what is going, we need to dig a little bit deeper. We need to understand the nature of the old business vs the new business. We need to understand why the future is bright and why the past is the past.

OLD BUSINESS

Mitcham Industries, a Texas corporation, was incorporated in 1987. The company was the world’s largest lessor of seismic and peripheral equipment to the oil and gas industry. It purchased seismic equipment from leading manufacturers and leased it out to seismic data acquisition contractors who performed seismic data acquisition surveys on land, in transition zones, and in marine areas.

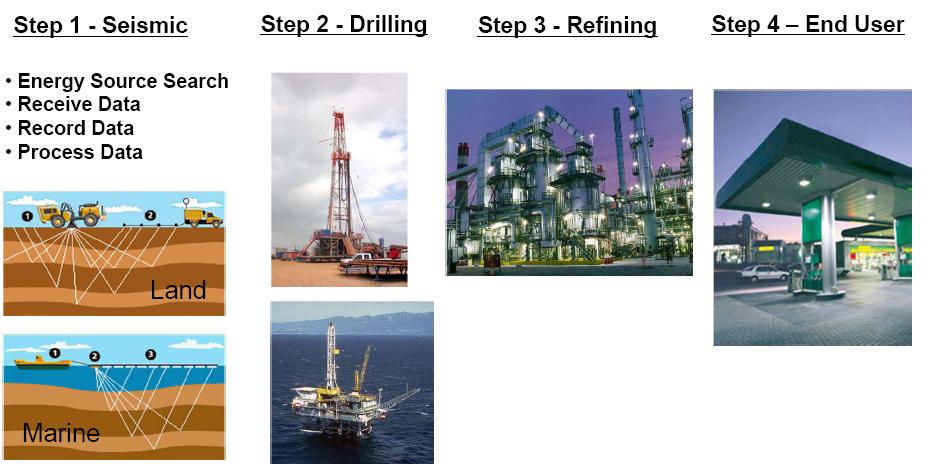

Seismic equipment is used by contractors to determine where to drill. Because drilling is an expensive undertaking, seismic surveys can save companies a significant amount of money because it decreases the likelihood of dry holes. Seismic surveying is the first step in producing energy:

Seismic contractors have two choices: they can either purchase or lease the equipment needed to conduct seismic surveys. Some choose to lease because it does not require a significant amount of capital, and it also allows them to supplement their existing equipment for specific jobs and gives them access to a large and diverse seismic equipment pool.

The seismic industry provides critical information to oil and gas companies who use it to acquire the data that is used to effectively locate oil and gas deposits. Seismic studies were first performed in the 1920s. In the most basic form, seismic data is acquired by first creating a small explosion in the earth which creates a vibration that is captured through sensors. This data is interpreted to produce detailed maps of exploration prospects and oil and gas reservoirs.

Demand for seismic services is influenced by the exploration and production activity in the oil and gas industry. When prices of oil and gas are high, then these companies search for new reserves, thus using seismic services. The price of oil and gas is affected by the end-user demand.

NEW BUSINESS

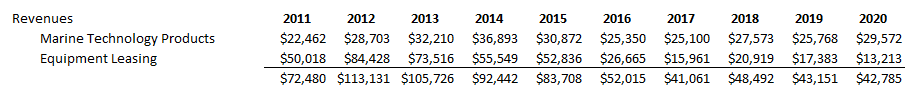

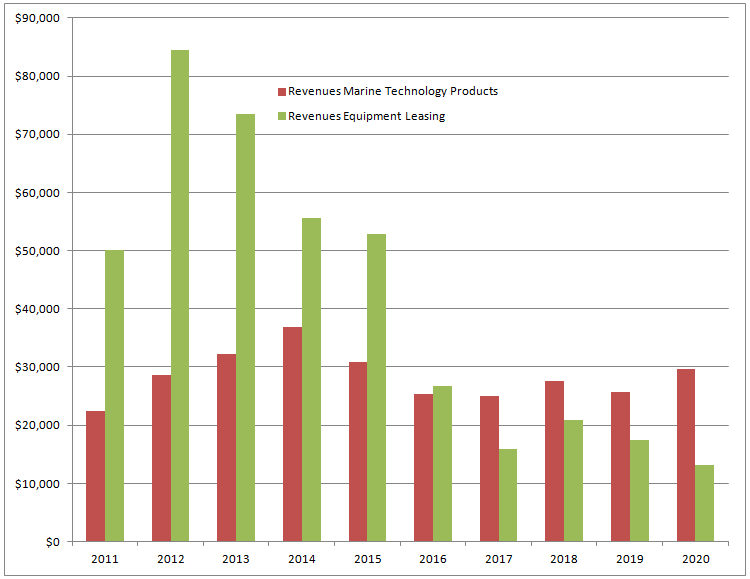

The new business segment is Marine Technology Products. Before I describe it in more detail, let’s look at the revenue mix.

From this graph, we can conclude two things. Equipment leasing business has been declining from 2012 to 2020. The Marine Technology Products business segment hasn’t really done much over the last 10 years. This segment became the main revenue contributor in percentage terms but it is still pretty much at the level that it was in 2012. So based on this chart, we still cannot see the huge transformation that I am talking about. Let’s continue.

The seed for the new business segment was kind of planted in 2005 when Mitcham Industries acquired Seamap. I say kind of because at that time, the company was leasing seismic equipment and it acquired Seamap in order to be able to manufactures and sell seismic equipment. So it was pretty much operating in the same sector with the same customers. Sometimes customers wanted to buy the seismic equipment (Seamap) and other times they wanted to lease it. In other words, it was all seismic, seismic, and seismic.

Then, something changed in 2015. Under the business strategy, Mitcham added the following bullet point:

-Develop and produce specialized equipment for the marine industry. We seek to identify opportunities to develop new product offerings in response to demand from the marine seismic industry and related industries. We think this will allow us to leverage our geographic footprint, engineering and manufacturing operations and customer relationships.

This was the first time that I saw Mitcham say “We like seismic but there are opportunities outside of seismic.” This is when I believe that the true seed was planted for the new business segment. Soon, the company acquired Klein Marine Systems (“Klein”).

At that time, there was no Marine Technologies Products segment. It was Equipment Manufacturing and Sales which was mainly Seamap. Now Klein was added to this segment. One year later, because of Klein, Equipment Manufacturing and Sales became Marine Technologies Products.

Klein Marine Systems is the reason why Mitcham is a 10x opportunity.

At the time of the acquisition, Klein had over forty-eight years of experience with the development and manufacture of high performance side scan sonar systems. I know, I know. What the hell is side scan sonar system?

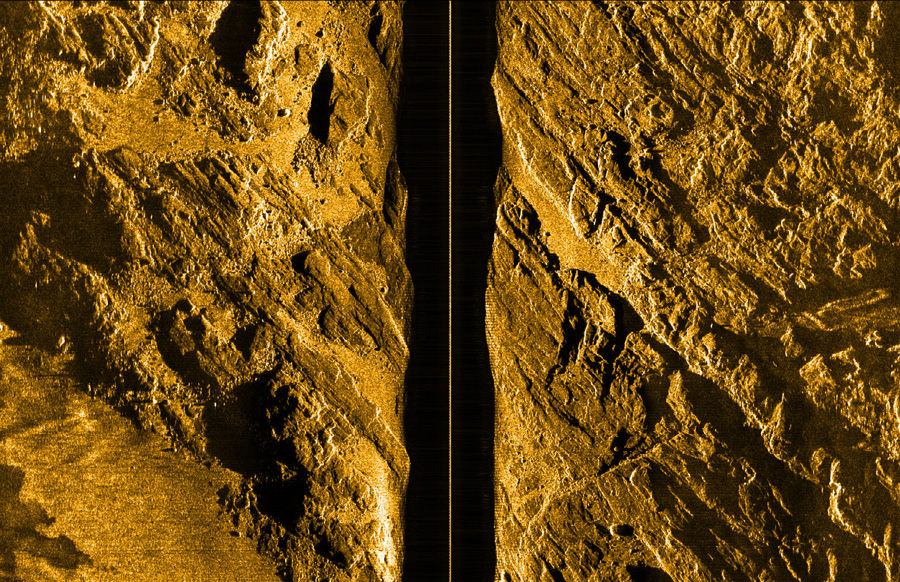

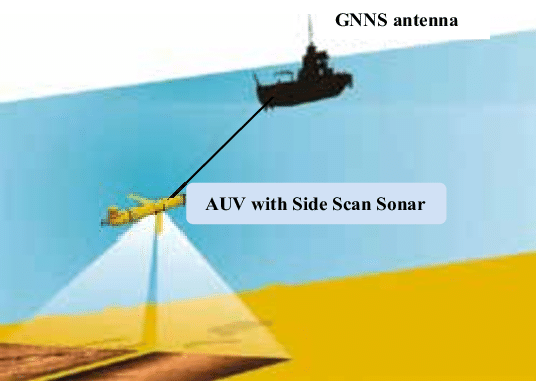

Side scan sonar is a way of creating an image of the sea floor. This is accomplished by using sound energy. A sound is send to the bottom of the sea and then it bounces back. This data is analyzed by the computer to give a picture of the sea floor.

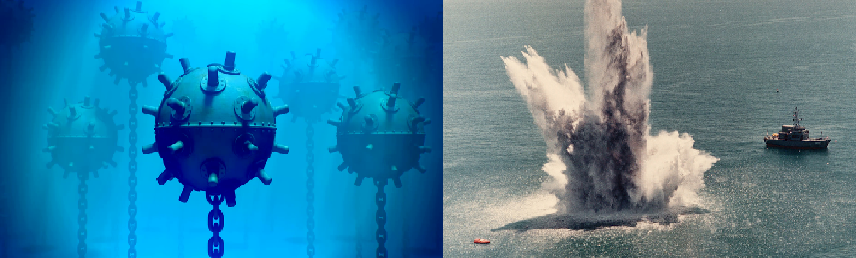

Why would you need that? Let’s say you are sailing a ship through the ocean. You want to know where you can sail not to hit the rock. We all watched movies with ships sinking. Today, it is a lot safer for ship voyages because we have technology to map out the sea floor. What about sea mines?

As a ship captain, wouldn’t you want to know where the sea mines are so that you don’t get blown up?

There are lots of applications for side scan sonar systems. They are used navies, port authorities, governmental organizations, and marine survey companies for hydrographic surveys, naval mine countermeasures, search and recovery operations, ocean bottom profiling, and other underwater object detection operations.

Ok, get to the point. Why should I care? There are plenty of companies selling this technology. What makes Mitcham so special?

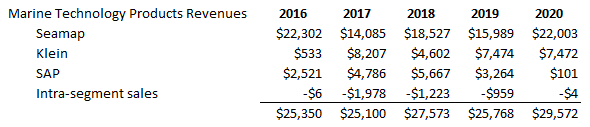

We are getting there. The following is the breakdown of Marine Technology Products business segment since Klein was acquired.

Nothing spectacular. In 2020, Klein contributed $7.4 million to overall revenues. The reason why Klein is about to explode is because of two things: 1) Technological breakthrough, 2) US Navy

US Navy

Let me start with the US Navy first. There is plenty written on this topic so I am not going to spend pages and pages explaining this. With that being said, here is a short summary.

With around 300 ships, US Navy is the most powerful maritime force in the world. In order to stay dominant, it must constantly improve. One of the areas of improvement or expansion is unmanned underwater vehicles.

The US Navy is investing tremendous amount of money into this area. Read the following article.

https://defensesystems.com/articles/2018/08/01/navy-unmanned-family-contract.aspx

The US Navy is spending close to $1 billion on a multi-year research and development program for unmanned underwater vehicles which could easily lead to multi-billion orders.

It selected a couple dozen of companies to support this program. Some companies include BAE Systems, Raytheon, and L3 Technologies. These companies are racing to increase capacity and technological capabilities in order to satisfy this growing demand for unmanned underwater vehicles. This is a multi-year trend that offers them an opportunity to make billions.

What does Mitcham have to do with this? This brings me to the next point – technological breakthrough.

Technological Breakthrough

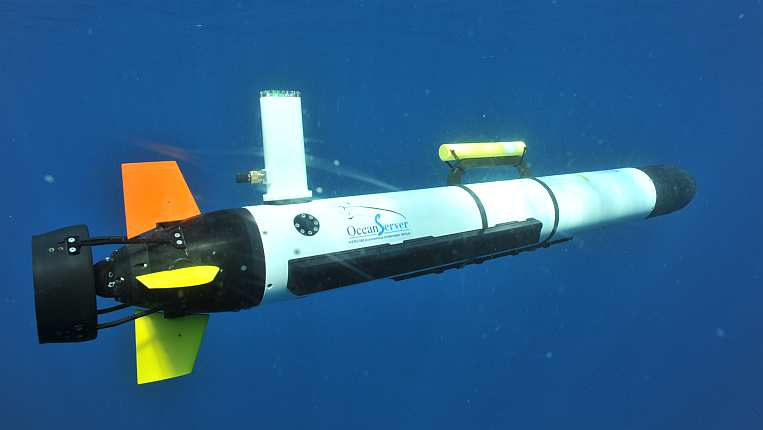

Here is an example of an unmanned underwater vehicle (UUV).

UUVs use side sonar scan systems to create images of the sea floor. That’s their purpose. The Navy can use them to find mines and all sort of other things.

Now Navy is asking the UUV’s manufacturers to come up with superior technology for these vehicles so that the Navy can stay a dominant force of the sea.

While this is happening, in April 2019, Mitcham came up with a technological breakthrough that fixed a major problem for the side scan sonar imaging.

http://www.freepatentsonline.com/20190331778.pdf

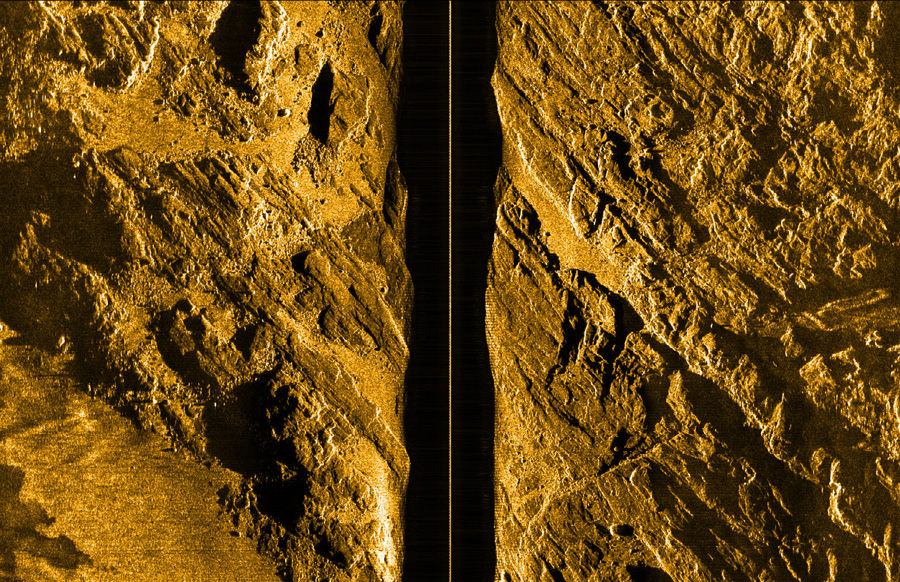

Remember this image?

This is an image created by side sonar scan. Notice the gap in the middle. It is called nadir gap. You can think of it as a blind spot in your car. It is created because the reading sensors on UUVs are located on each sides.

This gap can present major problems. What if there is a mine in that gap that was missed? In order to make sure that there isn’t one, the UUV has to rescan the area. This is time consuming and costly.

With Klein’s technological breakthrough, which is patent pending, there is no gap. This is a huge deal. What this means is that all the UUVs manufacturers that are looking to impress the US Navy have no choice but to use Mitcham’s Klein as a supplier of side sonar scan systems if they want to win the Navy contracts. This means that Mitcham is likely to reach revenues of hundreds of millions of dollars during the next 5 to 10 years.

CONCLUSION

Currently, Mitcham has a market cap of $23 million. With hundreds of millions of future revenues, this could mean $200 and even $500 million valuation. The potential is huge. I think that the stock is up 2.5x because somebody knows something. Could this mean imminent order? I don’t know. Time will tell.

For your due diligence, I suggest you read conference call transcripts to get the sense of opportunity and undervaluation. Read up on the Navy plans. Follow the news of UUV manufacturers. I will try to do some interviews. So treat this post as an introduction to Mitcham Industries.

Disclosure: Long Mitcham Industries