After I did my interview with Roberg Bugbee of Scorpio Tankers, there was a little bit of arguing among investors about the oil tanker fleet age. Because Scorpio Tankers has a new fleet, Bugbee said that having a new fleet is important. Those with shares of Scorpio Tankers agreed with Bugbee and felt good about owning shares in the company. However, those with shares in another oil tanker company with an older fleet, did not happily agree with Bugbee. They wanted to discredit his comments.

Let’s step back for a second. You know that everybody talks their own book, right? If you are a CEO of a company with a new fleet, of course, you are going to talk positively about having a new fleet. On the other hand, if you are a CEO of a company with an older fleet, you will talk about how great it is to have an older fleet because the loans of the older vessels are mostly paid off.

There is no right and wrong. As an investor, you can make money in both situations. It all depends on the price that you pay. Here is what I mean.

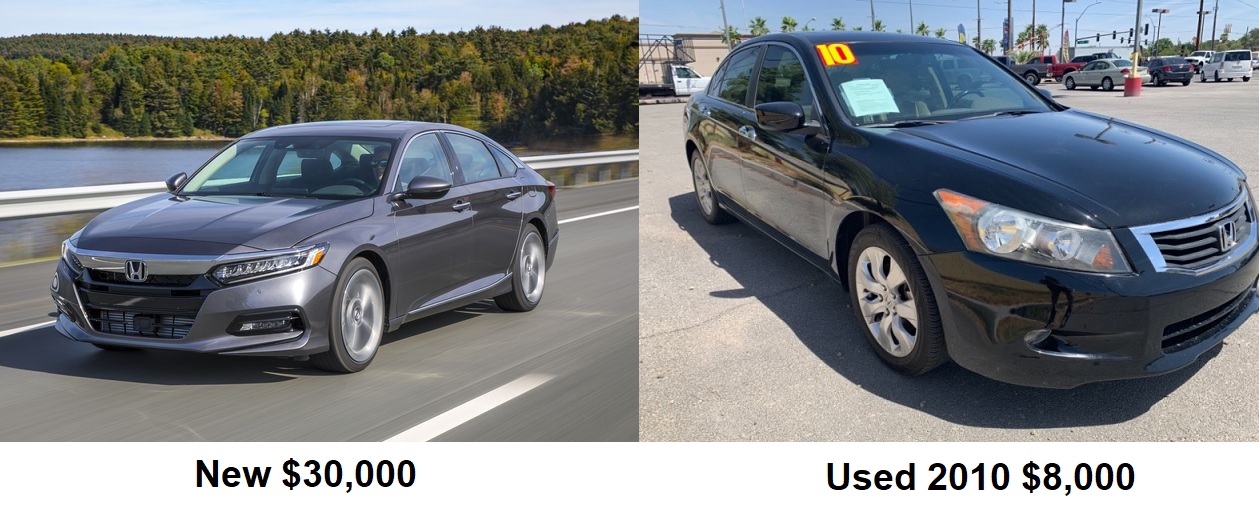

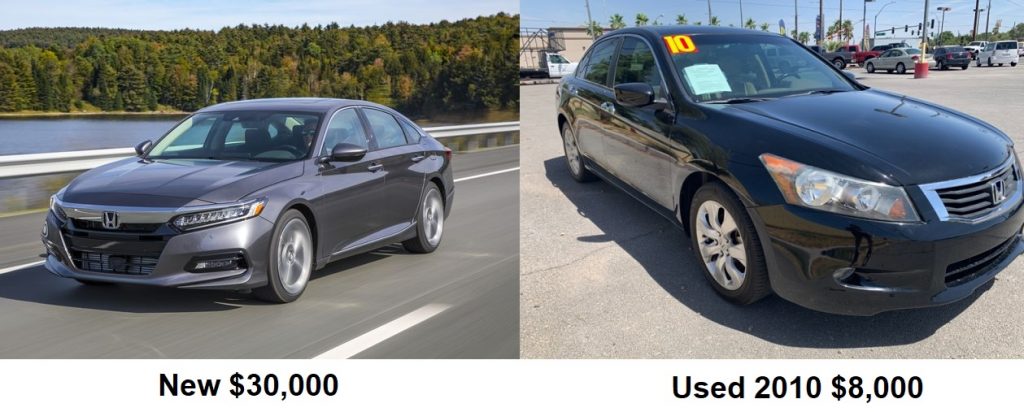

Let’s say you are in the market for a Honda Accord. You have two choices: 1) Buy new for $30,000 or 2) Buy used for $8,000. Which one is a better buy?

Some of you will say a new one is better because of some of the following reasons:

- smells better

- requires very little maintenance

- more fuel efficient

- will not break down

- runs smoothly

- prestige

Others of you will say that the used one is better for the following reasons:

- cheap

- get more miles per dollar spent

- more prudent

- less financially wasteful

- lower loan or no loan

No matter where you stand on this choice, I will say that you are wrong picking one versus the other. And I mean it from the point of view of an investor. You don’t have enough information to make a decision. It all depends on the price that you pay. As Warren Buffett said price is what you pay and value is what you get.

If you pay $30,000 for a new car that is worth $30,000 vs $8,000 for a used car that is worth $8,000, then there is no difference. You are not getting a deal in either case. Isn’t this what value investing is all about – buying something for less than it is worth? Price is what makes the difference.

So if you can buy the new Honda Accord, for $8,000, then you absolutely should take that deal over buying a used one for $8,000 no matter how prudent and responsible you are about the money. If you are considering buying a used Honda Accord for $30,000 when it is only worth $8,000, then you are an idiot.

You might say, “Mariusz but no sane person would ever sell you a new Honda Accord for $8,000. At the same token, no person would be stupid enough to buy an old Honda Accord for the price of a new one.”

You are absolutely right. It is very hard to find idiots in the real world transactions like this. Don’t look for idiot there. Look for them in the stock market. A huge amounts of money can be might by buying from an idiot (like a hedge fund) and selling to a business person in the private world.

Look at Guyana Goldfields (Ticker: GUY on TSX). In March 2020, you could have bought from an idiot for $0.25 per share. Today, you can sell it to a business person for $1.30. This is 5x in a matter of weeks. Why? Stock market investors were selling it hard because they didn’t think it was worth a lot. Then, Silvercorp Metals comes along to make an offer, the stock price jumped. Then, Gran Colombia came and made a better offer forcing Silvercorp Metals to double its original offer. This is a perfect example of buying from an idiot in the stock market and selling to a business person based on value. So focus on value.

There are hundreds of opportunities like this in the stock market that did not work out yet. Dover Motorsports, Oroco Resource, Gold X are all examples of this. I wrote about them many times. Most people are not interested.

Dover Motorsports is the only public player left in Nascar. Last year, International Speedway Corporation sold to Nascar (private company) for $2 billion. It was about $166 million per Nascar race. Speedway Corporation was taken private in $800 million transaction or $100 million per race. Dover Motorsports has two Nascar races and it is trading for $22 million per Nascar race. Buy from an idiot, wait, and sell to a business person. Hint hint.

Oroco Resource has a huge copper deposit that will probably be sold for between $300 million and $1.5 billion. Oroco is trading for $30 million. Hint hint.

Gold X has a deposit with NPV of about $1 billion. Market cap $70 million. Hint hint.

Anyway, back to the tankers since this is what everybody wants to be talking about.

Buying Scorpio Tankers today is like buying a new Honda Accord for the price of a used one. Buying Nordic American Tankers is like buying a 2003 Honda Accord for the price of 2013 Honda Accord. Not so smart. Buying Teekay Tankers is like buying a 2010 Honda Accord, for the price of 1993 Honda Accord. Not bad.

Conclusion

In conclusion, it is not super important how old or new your oil tanker fleet is. What is important is how much you are paying for whatever fleet you are buying. NAV already accounts for the age of the fleet. Pretty much all the oil tanker companies are selling for less than NAV (except maybe NAT) so you can relax. You are not overpaying. Eventually, the gap will close whether it be because of a buyout, share buyback or whatever. Count the cash. Figure out the value. Relax. Sit on your ass and wait.