There has been a lot of articles about USO and how the retail investors are piling into it just to get slaughtered. The thinking goes something like this “Crude oil is cheap. This is unsustainable. Buy USO.” I agree with the first two, but not the third one.

During normal times, USO does a pretty decent job of tracking the price of crude oil but during extraordinary times like these, this is not the case. You see USO tries to accomplish its mission by buying and selling/rolling over oil futures. It buys the front-month WTI futures but to avoid the physical delivery, it sells it before the expiration and buys the next month futures contract. Because the oil market is in contango, this guarantees disastrous results.

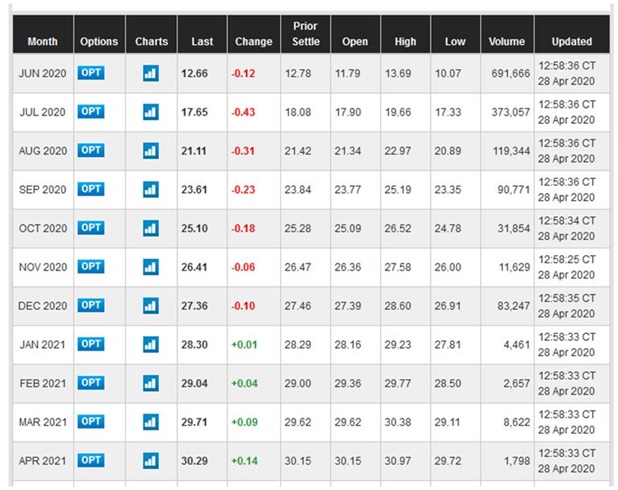

Contango happens when the price of the front month futures contract is lower than the price of the following months futures contracts. Here is an example of WTI oil futures contango.

As you can see, the June contract trades for $12.66 while the July contract for $17.65. The difference is contango.

Because of contango, USO is in the business of selling the front month futures contract for $12.66 and buying the following months contract for $17.65. It is constantly selling low and buying high. How many times can USO do this before it blows up? Not too many and considering that contango can be with us for many months, USO’s investors can potentially lose all their money.

In order for USO to work properly again, contango would have to disappear and for that to happen oil supply and demand would have to be in balance. That’s not going to happen anytime soon especially when USO is incentivizing the oil producers to keep producing. Yes, you read it correctly, USO is one of the reasons why oil producers will keep producing and thus destroying USO in the process.

Right now USO is involved in the first 4 contracts: June contract, July contract, August contract, and September contract. The allocations is 20 percent, 40 percent, 20 percent, 20 percent to June, July, August, and September, respectively.

Because the spot price of crude oil is very low, this should encourage some producers to curtail production. By why should they? The dumb retail money is plowing money into USO and thus creating a way out for these producers to get paid a higher price. Here is what I mean.

The oil producers, instead of selling spot, they are selling the futures contract to USO with the intention of delivering the crude oil in July, August, or September. The producers know that the oil storage is running out very fast but this is not their problem. They are shifting the storage problem onto the retailers that are piling into USO.

This exact topic was discussed by Jim Bianco in his interview. I compiled the most important clips here so take a listen.

In conclusion, it is always good to know what you are buying. Learn about USO and how it operates. If after that you still want to invest, then go ahead. At least, you will know how you lost all your money.

Here is Jim Bianco’s full interview.