Europeans and Americans are getting back to work. There are more cars on the roads. Saudi Arabia and other oil producers are hitting the brakes on output. The price of crude oil has doubled. All of which might give the impression that the much-ballyhooed floating-storage tanker trade is dead in the water.

Absolutely not true, according to executives of Euronav (NYSE: EURN) and International Seaways (NYSE: INSW), the latest in a parade of tanker owners reporting blockbuster earnings this week.

“The number of vessels taken in on floating storage continues to creep up every day. It will continue to increase and support our markets,” maintained Euronav CEO Hugo de Stoop, who described how the nature of floating storage has changed while its volume has increased.

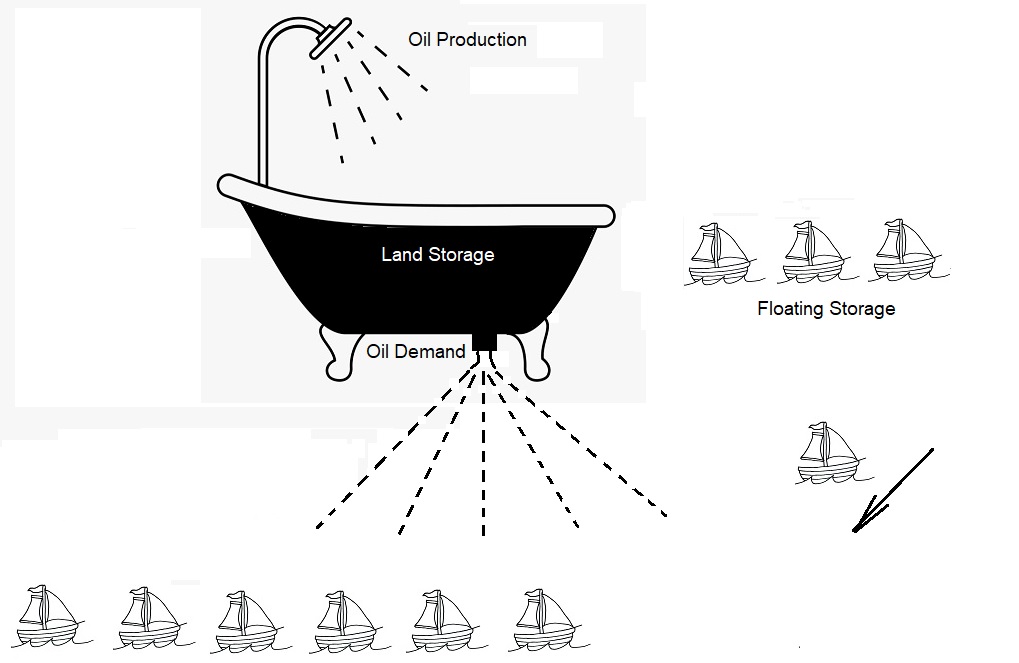

“Five or six weeks ago, traders were buying oil, chartering the ship, storing the oil on the ship and hedging themselves on paper,” he explained during the call with analysts. These were “contango” trades in which traders sought to buy oil low and sell it high.

Such deals, which were overwhelmingly six-month time charters with storage options, have waned. “The traders have balance-sheet limits. They’re not just trading oil and it’s not pretty out there,” said De Stoop.

The six-month charters that are now being signed are primarily being done by oil industry players. “The inquiries we’re receiving are from people lacking the space, who say, ‘I don’t know where to put my oil. I need to rent this ship,’” he said.