It is hard to go even one day without hearing something about how electric cars are going to replace internal combustion cars sometime in the future. So you ask yourself, “how can I make money from this trend?” After you realize that buying Telsa at any price might not be the best ideas, you start to think about battery metals such as lithium, cobalt, manganese, and etc. Eventually, you realized that copper is also needed for the electrification of cars as well as the electrification of everything around the world.

You start searching the Internet and you find plenty of advice and recommendations about buying Freeport-McMoRans, Rio Tintos, and BHPs of the world. While there is absolutely nothing wrong with buying these copper producers, there another way to make money from copper assuming you want to be a little bit more adventurous. By this, I mean copper juniors that have copper projects that will be bought by these major mining companies which have no choice but to replace their depleting copper reserves.

This article is not about any juniors in this space even though some names might be used as examples. This article is about copper porphyry deposits which supply more than 70 percent of world’s copper production.

COPPER PORPHYRY FORMATION

If you took chemistry in school, you are familiar with the periodic table of the elements which include copper, silver, gold, aluminum, and many others.

When it comes to the earth’s crust, these elements are everywhere. In other words, you can go to your backyard, mobilize some drill rigs, and you will find gold. Yes, you will find gold and bunch of other elements but before you start screaming that you struck gold, control your emotions before your neighbors call the police.

Even though these elements are abundant throughout the crust, they appear in such small quantities that they are simply uneconomic to extract. In order for them to be economic, they need to appear in concentrated quantities. This is essentially what ore is. It is a rock that contains a concentrated amount of copper, gold, or whatever and this concentration makes it economic to mine out. This elemental concentration or mineral ore is essentially what the mining exploration companies (juniors) look for. If they can find enough of it in particular areas, then their goal is to sell them to the major mining companies.

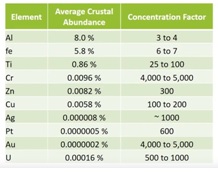

The following table shows the average crustal abundance and concentration factor that is needed to make the extraction economical. These are just averages and there are exceptions on both sides.

Let’s take copper which has a chemical symbol of Cu. As you can see, copper’s average crustal abundance is 0.0058 %. So if you have 100 pounds of rock, there is 0.0058 pounds of copper in it. Clearly this is not enough of copper concentration in order for you to mine and process 100 pounds of rock. At a price of $3 per pound, your revenue for this 100 pounds of rock would be less than 2 pennies.

According to this table, you need 100 to 200 times the average. In other words, you need copper grade of between 0.58 to 1.16 percent. So when you see exploration companies report drill results of close to 1 percent, investors get excited. With that being said, these are just averages and they should not be used alone to make investment decisions. Here is what I mean.

You can have a deposit with 1 or 1.5 % copper and this alone does not guarantee positive economics. The deposit might be too deep or too far away from infrastructure. On the other hand, you might have a deposit with 0.3% and even 0.2% copper with positive economics if the deposit is close to the surface and in an area with access to good infrastructure such as electricity, gas, water, rail, and port.

Now that you understand the element abundance and the concentration needed for ore deposits to be economic, the next concept that is useful to understand is how you get the concentration. What causes particular areas to have more copper? I say copper because this article is about copper porphyry deposits.

There are three basic requirements for the concentration process.

- Source of metal

- Transportation mechanism

- Trap or deposition

Source of metal

You already know that the metal such as copper is in the earth’s crust but it is also in the magma. So here is your source.

Transportation mechanism

Imagine boiling water in a pot.

When the water gets to a certain temperature, it turns from liquid to gas. It evaporates. Now imagine, if you did the same thing but covered the pot with a lid. The pressure would build up. Then, if you removed the lid, you would feel the pressure pushing the hot steam up to escape.

Now imagine, magma inside the earth’s crust.

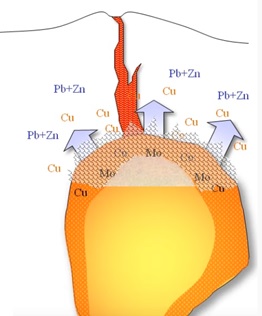

Magma inside the earth is like boiling water inside a covered pot. This trapped heat produces the transportation mechanism in the form of hot fluid and gas. This form of transportation is through hydrothermal fluids which dissolve and carry the metals such as copper, gold, silver, lead, zinc through the earth’s crust.

Trap or deposition

The pressure and temperature of the hydrothermal fluid is the highest the closest to the magma chamber. When the heat and pressure fracture the rock, more space and volume is created. Consequently, the temperature and pressure drop as the hydrothermal fluid travels away from the magma chamber.

When the temperature and pressure of the hydrothermal fluid drops, elements precipitate (turn into solid) and get trapped/deposited onto the encountered rocks. Various metals get deposited progressively because they precipitate at different temperatures. For example, copper and molybdenum get deposited first and lead and zink get deposited later.

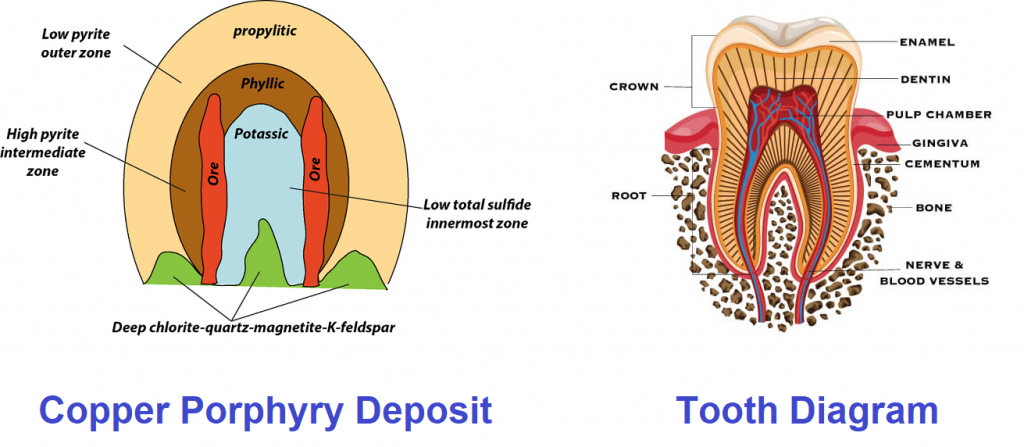

As a result of this dynamic, copper porphyry deposit kind of looks like a tooth diagram.

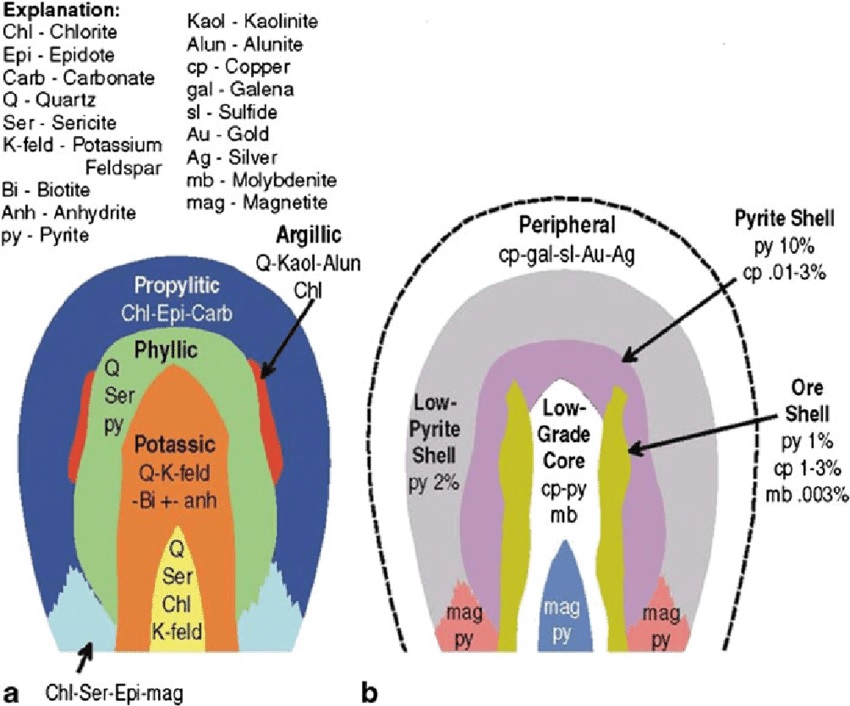

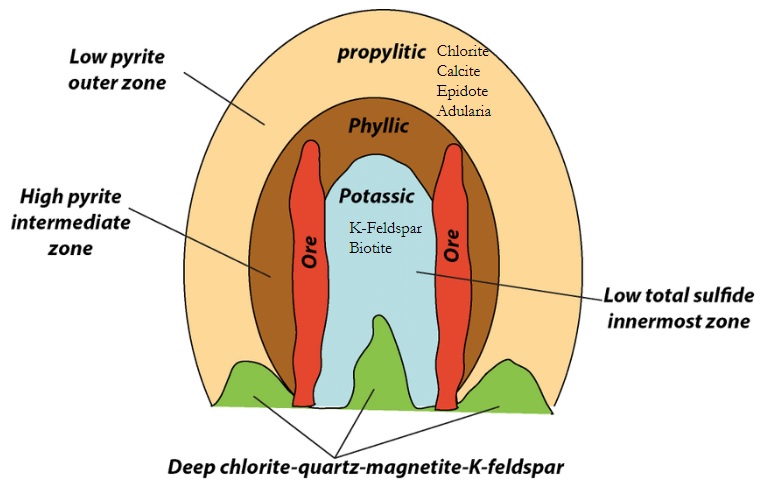

What you see in a copper porphyry deposit is the ore body and three alterations (potassic, phyllic, and propylitic). As the hydrothermal fluid travels away from the center, it alters the rock differently. When the pressure and temperature are high (potassic alteration), the hydrothermal fluid alters the rock in one way and when the pressure and temperature are low (away from the center – propylitic alteration), it alters it another way. The elements carried in the fluid also form chemical reactions with other chemical elements along the journey. This is why you read words such as chlorite, biolite, other confusing terms.

Here is another picture frequently used to show copper porphyry model.

On the left, the model shows the three alteration zones (propylitic, phyllic, and potassic) along with the ore body. On the right, it is the same thing but with the pyrite halo. This copper porphyry model was developed by David Lowell who had discovered a massive amount of porphyrys in his career.

When exploring for coppery porphyries, the exploration companies want to find the ores but the ores do not announce “Here are my exact coordinates. I am 2 km wide and 3 km long and 200 meters below the surface.” The geologists have to find them and to have a reasonable chance of success, they need to understand the copper porphyry systems.

The ore in copper porphyry deposits is usually located between the potassic and phyllic alternations. There is a pyrite halo surrounding the ore. Chlorite, calcide, epidote, and adularia are commonly present in the propylitic alteration. Pyrite is commonly found in the phyllic alteration. And K-feldspar and biotite are found in the potassic alteration. So if you are exploring, you are on the looked out for all of these things. They are clues and you get them through site visits, magnetic surveys, 3D IP, drilling, historical reports, and etc.

Let’s say you notice an interesting outcrop and you analyze the rock composition and you find out that it contains chlorite and epidote, you might conclude that this might be from the propylitic alteration zone. You might think that you are getting closer to the ore body. If you drill a hole that returns K-Feldspar and biotite, this might be a clue that you are getting even closer to the ore body.

Or if the deposit is close to the surface, you might even get outcrops of the actual ore, not just the alteration zone. Here is an example of a red gossan from Brasiles zone at Oroco Resource Corp’s Santo Tomas Copper Porphyry that I recently visited in Mexico.

This is the outcrop of the actual copper mineralization. This is a clue that copper is there and drilling will be needed to determine the grade and quantity. Here is what a geologist had to say when looking at the gossan. “And you start getting into the gossan as the quick tell that there is iron mineralization so chalcopyrite, pyrite.”

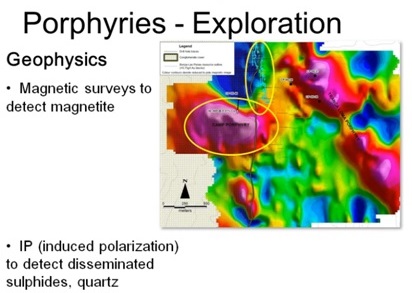

Exploration companies can also get clues by magnetic surveys or 3D IP surveys.

Magnetite, sulhides, and quartz are usually found in the pottasic alternation which generally hosts the bulk of the mineralization. So if you can get these things to show up on magnetic surveys or IP, then you can target your future drilling accordingly.

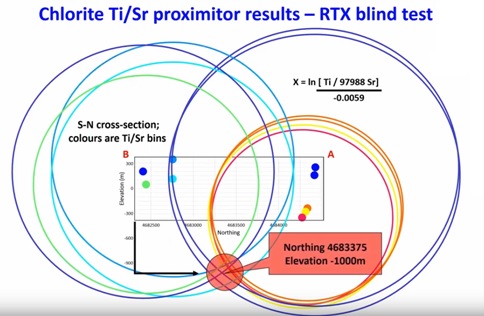

There is another interesting tool that geologist use to help find the core mineralization. It is called chlorite proximitor. Remember chlorite? It is usually found in the propylitic alteration zone. You take a bunch of chlorite samples and you enter each into an equation. The equation creates a circle for each sample and the cross of the circles is the target for the core.

Watch the following video for more information about this topic.

As you can see, collecting all these clues gives geologist a better idea of how to target the drilling campaigns. However, drilling itself is also about collecting clues.

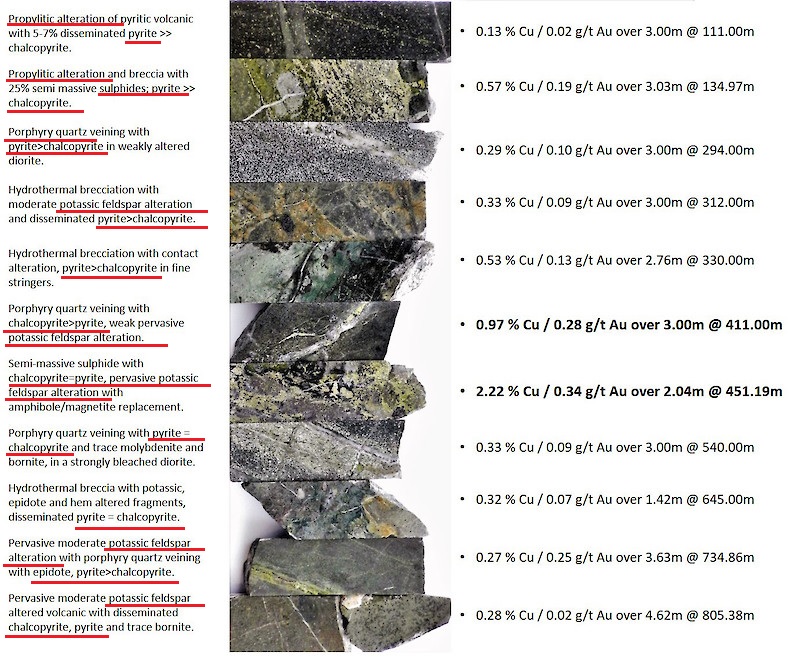

For example, on January 16, 2020, Kodiak Copper, owner of MPD copper-gold porphyry project, released some drill results. From the point of view of grade and length of mineralization, they were nothing special. Consequently, the market completely ignored it. However, the press release contained a lot of clues.

As you can see, a lot of clues were inside the press release. Words such as propylic alteration, pyrite, sulphides, chalcopyrite, potassic feldspar alteration, epidote were in there. The market should have recognized that the next hole or two were probably going to hit something more exciting. Instead, the market completely ignored it. Maybe the market did not understand what all this meant.

Then, on September 3, 2020, Kodiak reported a hole returning 0.70% copper over 282 meters. As a result of this, the stock price increased six-fold causing the market cap to increase from less than CAD $20 million to more than CAD $100 million. Yes, this happened just based on one hole even though the clues were all over the press release 8 months earlier. I guess the lesson here is that it is worth studying the geology and its terminology and how it relates to copper porphyry systems.

Solaris Resources, owners of Warintza Copper Porphyry Projects, is another company where we can use our newly acquired knowledge to understand what the press releases are trying to communicate. On August 10, 2020, the company reported a hole returning 0.80% copper over 567 meters. This is obviously fantastic. The press release also stated “Geological interpretation places this interval in the ‘outer halo’ of the porphyry system, with the higher-grade core to be vectored toward with additional drilling.”

By now, you should already know that by outer halo, they mean pyrite halo. This press release means that even though this hole is fantastic, this is not the core of the ore. With more drilling, they are hoping to find the core which according to the press release could contain even higher grade.

On September 28, 2020, the company announced two additional holes which returned 0.97% copper over 660 meters and 0.71% copper over 1,010 meters. “Geological interpretation suggest that the mineralization encountered to date is representative of the ‘outer halo’ of the porphyry system, with the higher-grade core to be vectored toward with future drilling locations.” This is pretty much the same message as in the August press release – great results but we still don’t think this is the core.

In the following presentation, Dan Earle, CEO of Solaris, explains how his company uses the information from these holes to further the understanding of the property’s porphyry system.

Starts at 14:00

“So the important thing, obviously, given the early stage of exploration here is pulling out the geological information from the observations we can make from the drill core. We describe this as being in the outer halo of the porphyry system. So we are looking at pyrite values in line with chalcopyrite so transitional from the pyrite shell and into the ore shell. And in terms of alteration, sort of phyllic alteration transitional to what we would describe as upper potassic. Certainly when we get to the core of the mineralization, we are going to expect to see much higher value of chalcopyrite and pyrite. We will expect to see much more intense kind of core potassic alteration and indeed bornite in place of some of the chalcopyrite. We’ve got evidence that we will have bornite core to this system.”

COPPER PORPHYRY DEPOSITS ARE VALUABLE

Now that you see how some of the clues can be used in exploring, let’s talk about the values of these deposits. You see copper porphyry deposits are huge and they can last for decades making careers and companies. The problem that the world is currently facing is the lack of exploration success over the last decade. This is during the time where copper demand is about to get much bigger.

Right now, the majors pretty much have no choice but to search for copper porphyry deposits deep inside the earth meaning underground deposits. This is because most of the close-to-surface or open-pittable copper porphyry deposits have already been found. Close-to-surface deposits are easier to find because they provide clues through outcropping of alterations zones and ore body. Also, drilling can be shallower and less expensive. Finally, they are much cheaper to put into production ($1 billion vs $5 billion).

Both Warintza of Solaris and Santo Tomas of Oroco are unique in this environment because they are both close to surface. The reason why they were not mined yet is because something stopped their developments. For example, Warintza faced local opposition for 20 years while Santo Tomas was tied up in a legal battle for 20 years. Only recently, both of these companies solved their problems and their stock prices delivered incredible returns to the shareholders.

Warintza is a bit ahead of Santo Tomas because the drilling is already taking place while drilling at Santo Tomas is likely going to happen in Q1 2021. What is interesting about Warintza is how the market is reacting to drilling and the results. Solaris is up 3 times since going public earlier this year. The company has a market cap of CAD $650 million. This is only after three new holes. This just shows you that the market realizes that these kind of deposits are billion to multi-billion dollar assets. Oroco’s market cap is only about a third of Solaris but I would not be surprised if Oroco reaches similar valuation once the drills start turning and results start coming in.

Here is a recent video of Cailey Barker from Blackrock talking about copper porphyry deposits. The discussion about valuation is particularly important to me.

CONCLUSION

I hope that this information was helpful to you. I believe that if we understand how the copper porphyry systems work, we will increase our chances of picking copper junior winners. Also, if we can understand the press releases better, we will be able to better anticipate the future exploration results better because we will keep our ears and eyes open to various clues.

Disclosure: Long Oroco, No position in Solaris and Kodiak Copper.

The following is a list of suggested video to take your understanding to the next level.

Geology of Copper

Mineral Deposit Formation

Porphyry-type Ore Deposits: Origins, Fertility Indicators and Exploration Targeting

Ore Deposits 101 – Porphyries, Skanns & IOCG

Porphyry-Type Deposits

Magmatic-Hydrothermal Systems and the Formation of Epithermal Deposits

https://www.youtube.com/watch?v=hkwGgvhR4mo

Roger Breuer, Arlington Group – Porphyry Wave Riders

Greg Corbett, Corbett Geological Services – Porphyry Wave Riders

Jamie Wilkinson, Imperial College London – Porphyry Wave Riders